In the digital age, online shopping has become a cornerstone of convenience. Among the rising stars in e-commerce, Temu has captured the attention of shoppers worldwide with its enticing deals and diverse product range. Yet, with every new platform, questions about safety and security naturally arise. Specifically, many users wonder: Is Temu safe to use a debit card?

In this article, we’ll explore Temu’s features, security measures, and best practices for ensuring safe transactions.

What is Temu?

Temu is a rapidly growing online marketplace that offers a wide variety of products, from electronics and fashion to home goods and more. Established with a focus on affordability, it appeals to bargain hunters looking for quality products at competitive prices. The platform connects buyers directly with manufacturers and suppliers, often reducing costs compared to traditional retail channels.

Temu prides itself on user-friendly features such as streamlined navigation, customizable product recommendations, and multiple payment options. These features contribute to its rising popularity. However, as with any online platform, users should assess the safety of their personal and financial data before engaging.

Is Temu Safe to Use a Debit Card?

When it comes to online shopping, the question of payment security is paramount, especially when using a debit card. Debit cards draw funds directly from your bank account, making it crucial to ensure the platform you’re using is secure.

Let’s explore whether Temu is a safe option for debit card transactions by examining its security features, common user concerns, and practical ways to safeguard your financial data.

1. Understanding Debit Card Vulnerabilities

Debit cards, while convenient, are integrally riskier than credit cards for online shopping. This is because they provide direct access to your bank account without the buffer of credit protections. Unlike credit cards, which often come with fraud liability protections and dispute mechanisms, debit cards can leave you more exposed if unauthorized transactions occur.

With this context, it’s critical to assess Temu’s safeguards to determine whether it’s a secure environment for debit card payments.

2. Temu’s Security Infrastructure

Temu leverages industry-standard security protocols to protect user data and payment information. Below are the key features that enhance its safety:

● SSL Encryption

Temu employs SSL (Secure Socket Layer) encryption, which creates a secure channel for data transmission. This means that when you enter your debit card details, the information is encrypted and can only be decrypted by the intended recipient, minimizing the risk of interception.

● Payment Card Industry Data Security Standards (PCI DSS)

As a PCI DSS-compliant platform, Temu adheres to rigorous security standards designed to protect cardholder data during transactions. This compliance reassures users that the platform meets global benchmarks for payment safety.

● Real-Time Fraud Detection

Temu uses sophisticated fraud detection systems to monitor transactions for unusual patterns. This includes identifying attempts to access accounts from unfamiliar devices or locations and adding an extra layer of protection.

3. User Concerns and Risks

Despite Temu’s security measures, users may still face certain risks associated with using a debit card:

● Phishing Scams

Cybercriminals may create fake versions of Temu’s website or send fraudulent emails that mimic official communication. These scams aim to trick users into entering their debit card information on compromised platforms.

● Account Breaches

Weak passwords or reused credentials across platforms can make your account vulnerable to hacking. If an unauthorized party gains access to your Temu account, they could misuse stored payment details.

● Delayed Refunds

Some users have reported challenges with refunds on Temu, especially for canceled or disputed transactions. Unlike credit cards, where disputes are often resolved quickly, debit card refunds can take longer, potentially leaving your funds tied up.

4. Best Practices for Safe Debit Card Use on Temu

While Temu employs robust security features, your vigilance plays a vital role in ensuring safe transactions. Follow these best practices to reduce potential risks:

1. Use Virtual Debit Cards

Many banks now offer virtual debit cards, which are designed specifically for online transactions. These cards generate a unique number for each transaction, minimizing the risk of your actual debit card details being compromised.

2. Enable Two-Factor Authentication (2FA)

Protect your Temu account by activating 2FA, which requires a secondary form of verification (like a text message or email code) in addition to your password.

3. Monitor Your Bank Account Regularly

Keep a close eye on your bank statements to quickly identify unauthorized charges. Report any suspicious activity to your bank immediately to minimize potential losses.

4. Avoid Storing Card Details

While Temu allows you to save your card information for faster checkout, it’s safer to enter your debit card details manually for each transaction. This reduces the risk of stored data being accessed in the event of a breach.

5. Verify Temu’s URL and App Authenticity

Always ensure you’re shopping on Temu’s official website or app. Look for the “https://” prefix in the URL, indicating a secure connection, and avoid clicking on links from unsolicited emails or messages.

6. Shop on Secure Networks

Public Wi-Fi networks are notoriously insecure, making them a prime target for hackers. Always shop on a secure, private network when entering sensitive payment information.

5. Pros and Cons of Using a Debit Card on Temu

Pros:

- Temu’s adherence to PCI DSS standards ensures a high level of payment security.

- Encryption technology protects your data during transactions.

- Advanced fraud detection systems minimize unauthorized activity.

Cons:

- Direct access to your bank account makes unauthorized transactions riskier.

- Refunds for debit card purchases can take longer compared to credit cards.

- Greater vulnerability to phishing scams and account breaches without user vigilance.

6. Alternative Payment Options

If you’re still uncertain about using a debit card in Temu, consider these alternatives:

- Credit Cards: Offer better fraud protection and easier dispute resolution.

- PayPal: Acts as a secure intermediary, ensuring that your debit card details are not shared directly with Temu.

- Digital Wallets: Many platforms allow you to link your debit card to a digital wallet for added security.

Conclusion

So, is Temu safe to use a debit card? The answer largely depends on your approach to online shopping. Temu implements robust security measures, including encryption and fraud detection systems, to protect users. However, no platform is entirely immune to risks.

By following best practices—such as enabling 2FA, using virtual debit cards, and shopping on secure networks—you can significantly reduce your chances of encountering issues.

Temu’s rising popularity and commitment to security make it a viable option for online shopping, but caution and vigilance are always recommended when using a debit card.

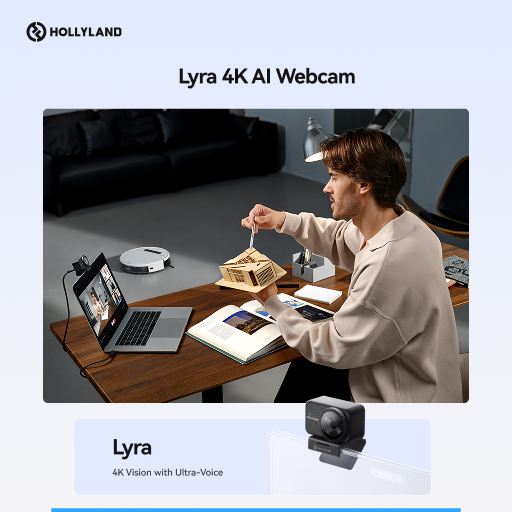

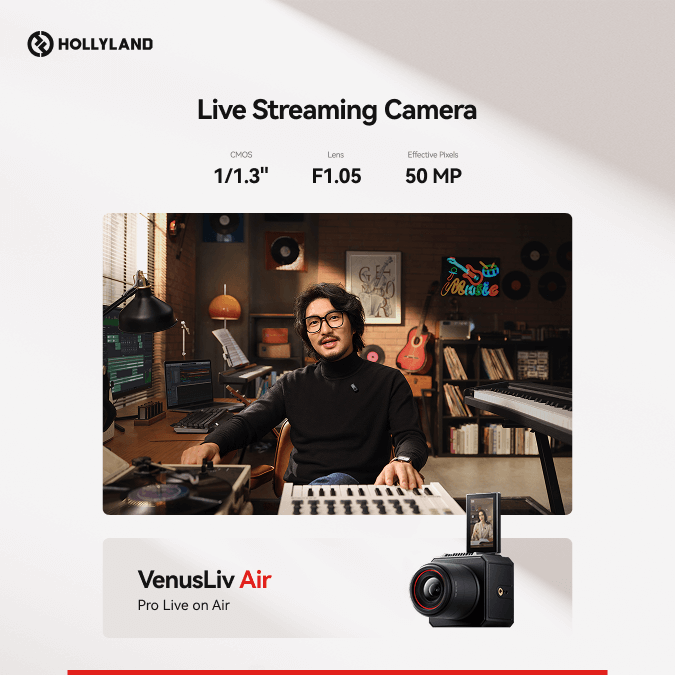

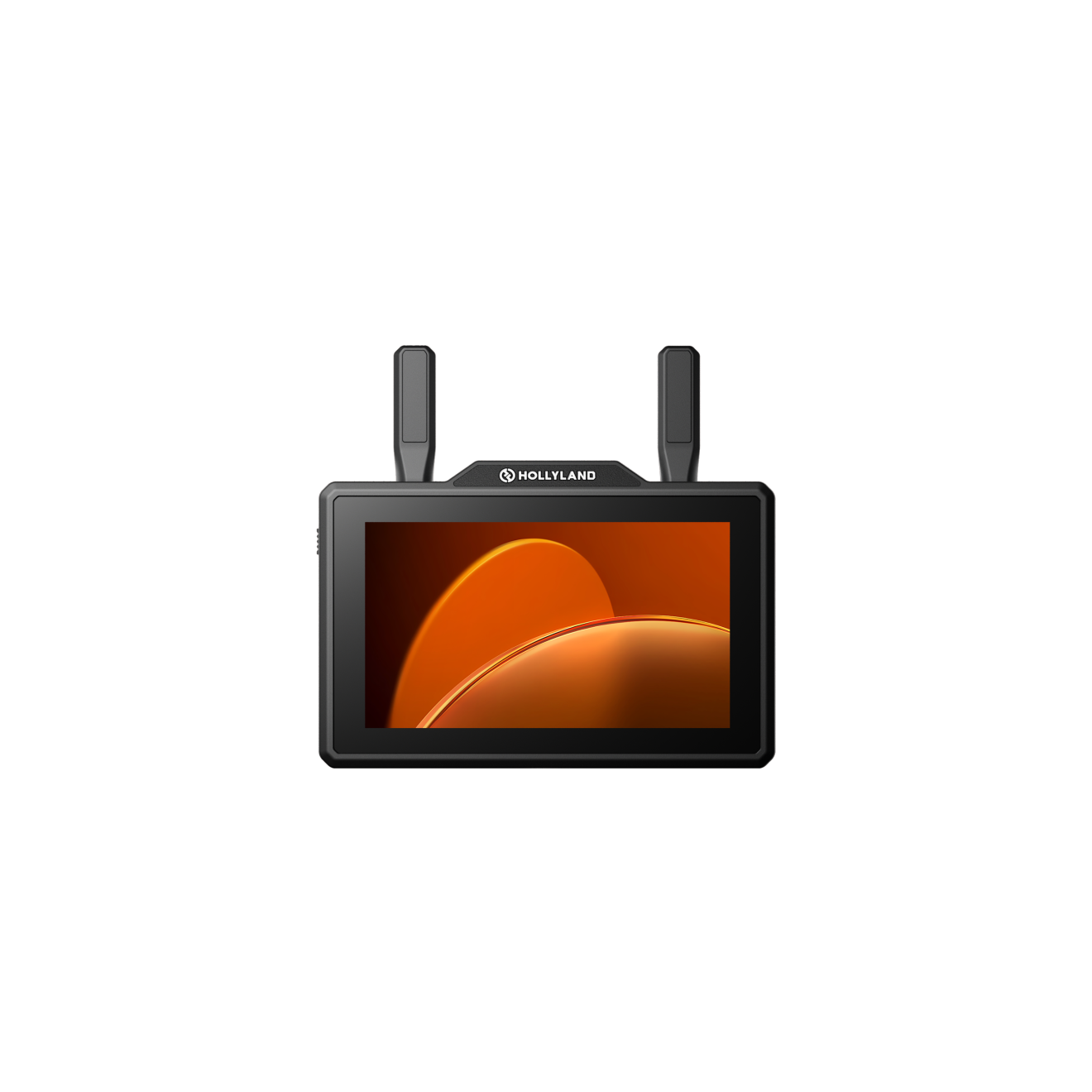

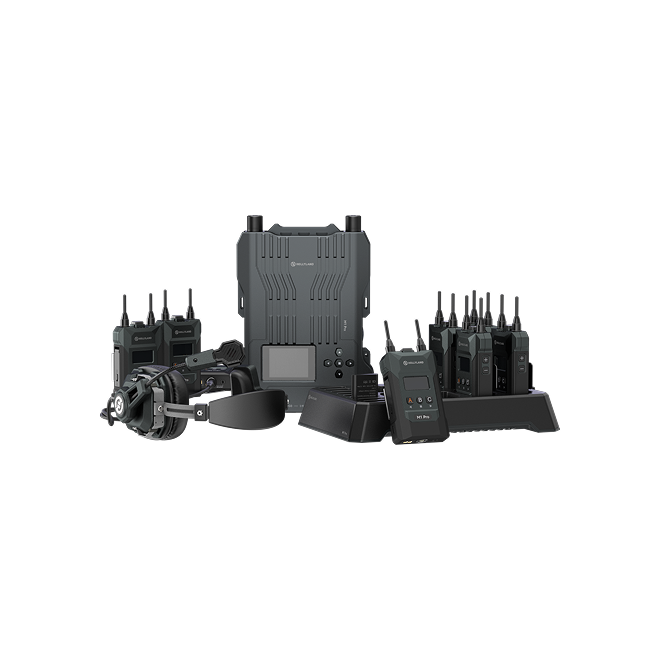

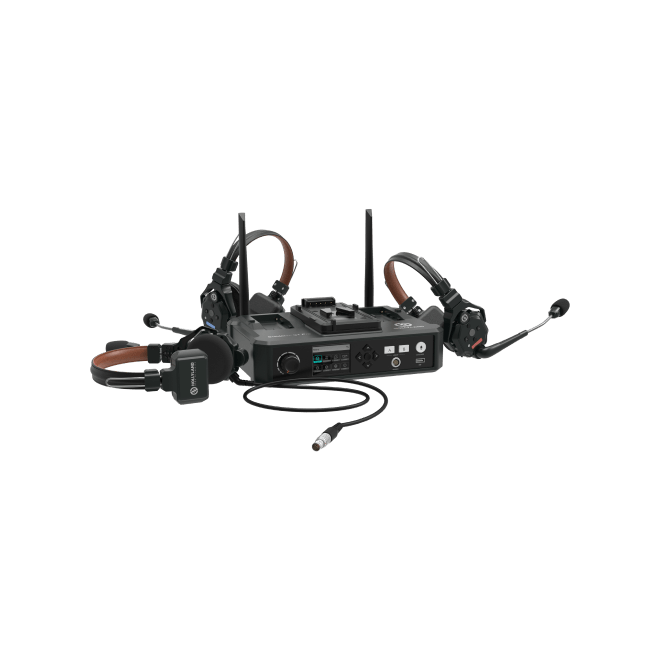

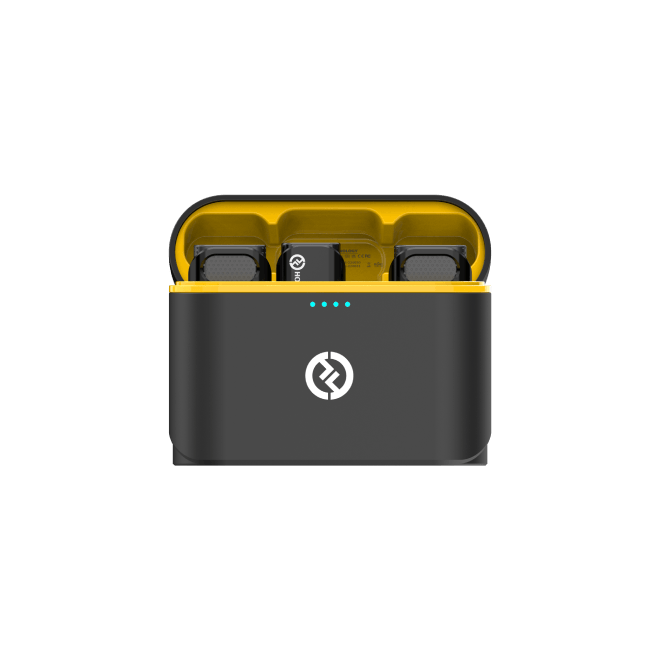

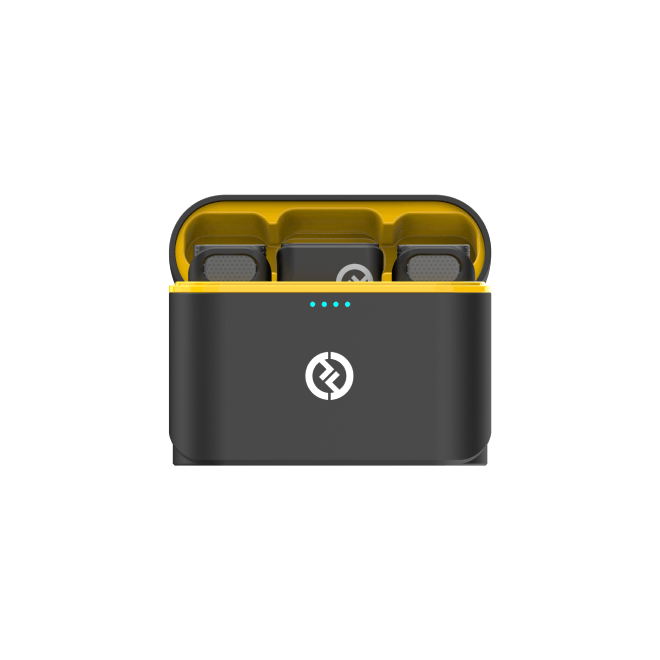

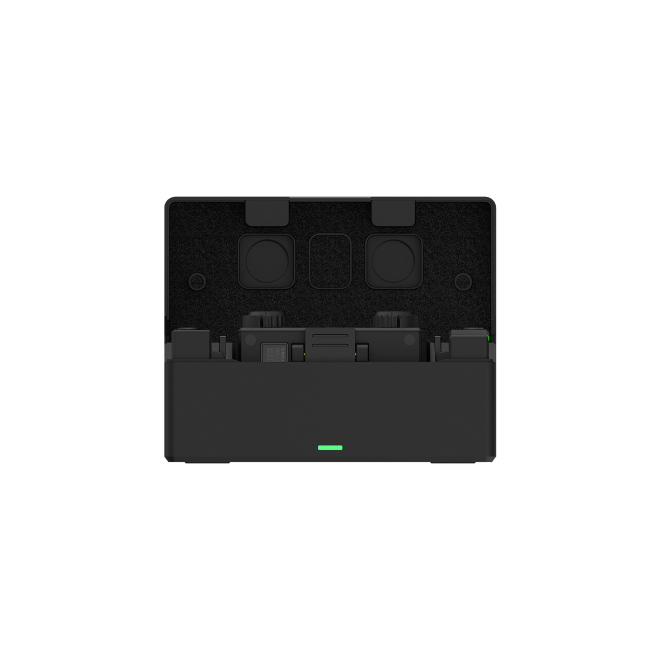

Keep in touch with cutting-edge wireless technology! Explore Hollyland’s blogs to get the most up-to-date information on wireless solutions, video transmission, Technology, and professional advice designed for content producers and creators in a dynamic environment.

To enhance your experience, visit our website for a range of products, including video solutions, intercom systems, wireless microphones, and cameras, tailored to meet your ultimate production needs.

FAQ

1. Can I trust Temu with my debit card information?

Yes, Temu uses advanced encryption and complies with PCI DSS standards to protect users’ payment information. However, users should follow safety practices to ensure secure transactions.

2. What should I do if I notice unauthorized charges after using Temu?

Contact your bank immediately to report the unauthorized charges. Most banks have fraud protection policies that can help you recover lost funds.

3. Does Temu offer alternative payment methods?

Yes, Temu supports various payment options, including credit cards, PayPal, and sometimes digital wallets. If you’re concerned about using a debit card, consider one of these alternatives.

4. How do I recognize phishing attempts related to Temu?

Look for signs such as misspelled URLs, poorly formatted emails, or requests for sensitive information. Always verify the website’s legitimacy before entering any details.

5. Is it better to use a credit card instead of a debit card in Temu?

Using a credit card can offer additional protections, such as chargebacks and fraud protection policies, making it a safer option for online shopping.

By staying informed and adopting secure online practices, you can confidently enjoy the convenience and deals Temu has to offer. Happy shopping!

.png)